OECD's Pillar Two: Global Minimum Tax Update, IIR to be Implemented in Switzerland 2025

OECD's Pillar Two: Global Minimum Tax Update, IIR to be Implemented in Switzerland 2025

- At its meeting on 4 September 2024, the Federal Council decided to introduce the Income Inclusion Rule («IIR») as of 1 January 2025 in addition to the Swiss supplementary tax («QDMTT») that was already introduced on 1 January 2024.

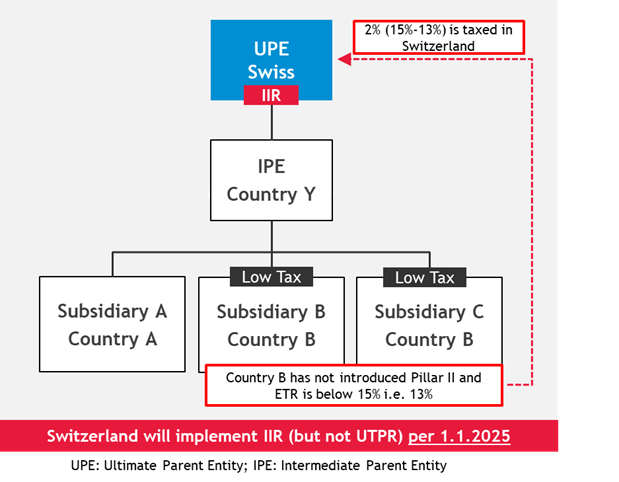

- Under the IIR, the profits of direct and indirect foreign subsidiaries of Swiss constituent entities will be subject to a minimum tax rate of 15%, if they are part of a multinational group that generates consolidated revenues of at least EUR 750 million and thus falls within the scope of the OECD minimum tax.

- The IIR applies in cases where any undertaxed excess profits are not already covered by a qualified domestic minimum tax («QDMTT»). See the example below.

- The Federal Council argues that by introducing the IIR, Switzerland is securing tax revenue that can be used to strengthen the country as a business location. If Switzerland had not introduced the IIR, the foreign tax base that will be taxed with the IIR in Switzerland as of 2025 would have been subject to the Undertaxed Payment Rule («UTPR») in other countries in most cases.

- On 4 September 2024, the Federal Council also decided not to introduce a UTPR in Switzerland for the time being.

- The introduction of the IIR is subject to a necessary amendment of the ordinance («Mindestbesteuerungsverordnung, MindStV») later this year. The communication of the decision of the Federal Council regarding this amendment will be the final enactment date then. However, the introduction of the IIR in Switzerland is already substantially enacted for IFRS purposes as of 4 September 2024.

Please see the prior BDO information for more information with respect to OECD's Pillar Two Rules and its implementation in Switzerland (OECD Minimum Taxation: Its Impact on Switzerland).