New US tariffs

Strategies for Swiss companies

Global Risk Landscape 2024

A BDO Legal Guide to European Tech Regulations:

A concise overview for companies

Sustainability at BDO

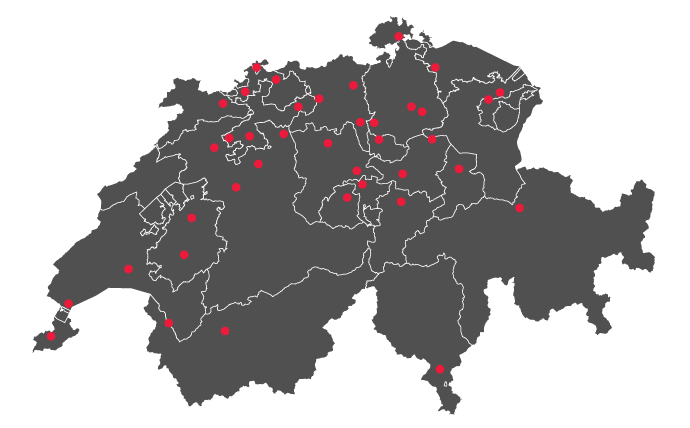

BDO: 166 countries - one organisation - globally connected

Uniquely built to provide exceptional client service, always and everywhere

New US tariffs

Strategies for Swiss companies

Global Risk Landscape 2024

A BDO Legal Guide to European Tech Regulations:

A concise overview for companies

Sustainability at BDO

BDO: 166 countries - one organisation - globally connected

Uniquely built to provide exceptional client service, always and everywhere

New US tariffs

Strategies for Swiss companies

Global Risk Landscape 2024

A BDO Legal Guide to European Tech Regulations:

A concise overview for companies

Sustainability at BDO

BDO: 166 countries - one organisation - globally connected

Uniquely built to provide exceptional client service, always and everywhere

New US tariffs

Strategies for Swiss companies

Global Risk Landscape 2024

A BDO Legal Guide to European Tech Regulations:

A concise overview for companies

Sustainability at BDO

BDO: 166 countries - one organisation - globally connected

Uniquely built to provide exceptional client service, always and everywhere